Recession Profit Secrets is designed to be a program to help you prepare for economic turmoil basically. But after getting and reading it (you’ll get an inside look in this review), to me, there’s just too much doom and gloom talk, and as for solutions, there’s also some cons in my opinion.

My goal in this review is to share what you get from Recession Profit Secrets, give you my perspective on it, help you decide if it’s something you can benefit from and at the same time show you what I personally do to prepare for economic turmoil and why I consider it a better prep than what this program recommends. Let’s begin:

Recession Profit Secrets info:

Who created Recession Profit Secrets?

Richard Pierce.

How much does Recession Profit Secrets cost?

Normal product is $37 (downsold to $27 if you try to leave the checkout page). This is the one I got.

Additionally, there are a few upsells (none of which I purchased):

- $67 (Accelerator program).

- $67 (Premium Masterclass).

- $47 (Ultimate Crisis Protection System).

What is Recession Profit Secrets all about?

The main program is a 5 module eBook “course” on understanding the “truth” about economics and how close society is to a financial collapse, why they should invest in things like gold and how to basically protect and hedge your investments against this crisis.

A lot of what Richard talks about is very doom and gloom in some ways, but frankly, it is warranted and I have personally heard and read a lot about this stuff outside the program, so some of the content was very familiar to me.

My rating for Recession Profit Secrets: 2.5 out of 5 stars

Do I recommend Recession Profit Secrets? Not really.

Again, one of the MAJOR things I disliked is the doom and gloom element of the sales page, and how much of the content inside the modules in my opinion is very manipulative of people’s feelings (the end is nigh kind of stuff).

While I believe there is a lot of truth to what Richard says, in my opinion, the basic program is kind of leading people to buy the upsells to “solve” that problem. And all that fear talk is just not my kind of thing.

I believe in preparing yourself for economic turmoil sure, but in all honesty, I don’t see much difference in this program than stuff I would find on places like YouTube from “preppers” and conservative channels talking about protecting yourself financially. In fact, I’d say you can get equally good if not better content from them, for free than you would in Recession Profit Secrets.

Maybe the upsells get into more details on that, but the basic idea of what I saw in the 5 modules was:

- Doom and gloom approaching.

- Buy gold and silver.

- Consider cryptocurrencies.

Alternatives? Yes.

A detailed review of Recession Profit Secrets:

So to start, here’s a look at the members area of this program:

Now for details (the 5 modules):

Once you get inside the program, there is a “quick start guide” which summarizes the 5 modules. It is 31 pages long.

1) Next is Module 1, which is 48 pages long and introduces people to how banking systems manipulate currency and your money. If you have ever seen conservative channels and people talking about quantitative easing, fiat currencies, inflation and so forth, this is basically the same stuff.

2) Then you get to Module 2, which is 82 pages long and dives deeper into quantitative easing, talks about the past US presidents, particularly Bush, Obama, the housing collapse/crisis and how they helped create much of the crisis that is getting worse since. There is more talk of quantitative easing (which is printing of money) and how the inflation is coming.

3) Then we have Module 3, which in a nutshell discusses the value and importance of owning precious metals (gold and silver). There is a lot of history talk in this module (it’s 42 pages long) and stresses the importance of that.

4) In Module 4 (54 pages), there is a lot of talk about blockchain technology, and cryptocurrencies (which I am not really educated on to be fair), and discusses how this “decentralization” of it can help protect your money as it’s not as easily manipulated as cash/fiat money.

5) In Module 5 (60), there is a lot of talk about Bitcoin, it’s uses and how it’s becoming more and more active around the world as a currency of exchange. I do admit, this module has a lot of good value for people who are completely new to the concept (like me).

The rest of the members area basically pitches the original upsells I labeled earlier and honestly, I don’t see any reason to buy it.

Bonuses in Recession Profit Secrets (meh):

1) There are 3, 20 minute+ videos talking about similar topics and honestly, I found it very difficult to listen to, just because the subject matter is very negative in general and it’s a cartoon of people writing, while Richard (I assume he’s the voice) talks it out. I honestly didn’t like this part of the program.

2) Then there’s also 3 Wealth Guides, and 2 of them focus on making online accounts with Coinbase and the other with Exodus (a cryptocurrency site). I don’t know much about those things, but I’d be very careful with any of this stuff.

My personal history and views on the stuff Recession Proof Secrets talks about:

There was a time during the United States housing bubble in 2008 that I studied and looked deep into the stuff Richard talks about. However during that period, cryptocurrency wasn’t a thing and I did invest in gold and silver.

And a lot of the subject matter Richard discusses is very familiar to me, because I did study a lot of this from economically intelligent people I trusted. All this stuff about the collapse, economic bubbles, quantitative easing and doom is very familiar talk to me.

This is very important to understand:

Now I do admit, when I first began studying this stuff, I became depressed, because how can you not, when all you hear is about collapses, the end being near and so forth.

Eventually, that actually destroyed my ambition and made me pretty depressed. Don’t get me wrong, I am all for preparing, educated and doing things to build financial independence, security, and having asset/finances for a rainy day (or the end of the world), but it’s one thing to do it in an optimistic way, and another to look and see the end being near all around you.

The latter is what I felt most of the time when I dove into this stuff and it’s one of the reasons why I stopped listening to these things, not because they were “wrong”, but because listening to the end being near and all that negativity destroyed my ambition and to this day I stay away from this stuff as much as I can.

Even if what people say is right (And I do agree with Richard on many parts here), you can make productive and positive conclusions/actions on it vs being in a fearful state, that ironically would in my opinion hinder your ambition to do what’s necessary to prepare in the first place.

This is one of the reasons why I said I very much disliked all the doom and gloom talk on the sales page and modules. It brought me back to those old days where I read, watched and studied this stuff and how depressed I got over it.

I refuse to promote stuff as an affiliate that scares people and feeds off negativity like this. It’s just not ethical affiliate marketing in my opinion.

Conclusions: Want to build stability? Consider starting a digital business.

Let’s be clear: Protecting your assets and building financial security involves actually having that in the first place.

And most people from what I know don’t have the type of money to invest in gold, silver, real estate and cryptocurrencies to begin with (and even if they do, there’s lots of predatory people and programs out there where you can lose your money on anyway).

But there’s one very important thing that in my opinion has that potential:

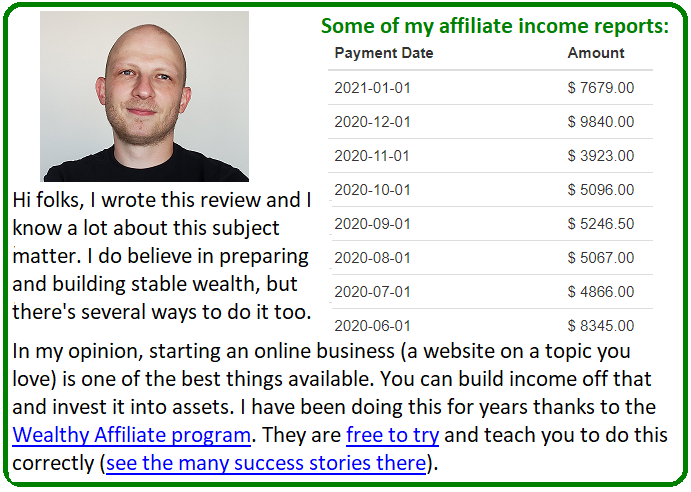

Starting an online business (that’s what I did). That is one type of asset that I began growing in 2007 and do to this day and it’s something that has allowed me to dive into the other, more stable markets to invest in that. See my affiliate income reports.

- It’s cheap to start.

- It has an infinite amount for growth.

- It’s elastic and can withstand economic recessions/depressions.

Here’s how it works:

- You start an online business based on a niche you love.

- You build a website off that and attract visitors who have the same interests.

- You sell these visitors stuff that they like.

- You then reinvest the money earned, start a new site, scale that and/or invest in the type of stuff Richard talks about.

In the context of this review, think about people who are scared of the future and economic collapses. They can build a site on prepping for that (and there’s many online businesses booming off that right now by the way). But besides that, this doesn’t have to be your niche, and there’s tons to choose from besides this.

Starting an online business takes time and work, but this is a digital asset that is actually very inexpensive to start and can have massive elasticity when times are down. In fact, in my case, I follow this formula, do affiliate marketing (promote stuff) and affiliate marketing during a recession is still something you can profit from.

Plus, there is a lot more positivity to this approach. Why?

Because instead of biting your nails and waiting for the end to come (if it ever does), you are building something of substance that you love and having that be the gateway to your financial independence. That in my opinion is a much more constructive and positive way to get more out of life.

Want to start? Here’s where you do it:

The best place out there in my opinion which will teach you all of this about digital businesses, niche marketing and so forth is Wealthy Affiliate. It’s where I got my start in growing an online business (and still do this day) that allowed me to live a financially free lifestyle and be able to have money to invest in assets, and grow my safety nest.